Stakeholder communication and relations, especially those with customers, business partners and investors need to be seamless. We are conscious of the need to build long-term relationships and collaborations through partnerships.

Investors are the stakeholders who provide the capital for the Bank to operate. The Bank therefore has a responsibility to be transparent to them to the maximum extent practicable. This includes detailed information on all aspects of the Bank’s performance present and past, policies, forecasts for future performance, future plans strategies and risks. The Bank also discloses information to the general public in accordance with regulatory requirements and its own policies in the media, on its website and on the Tadawul.

The Bank’s Articles of Association and Corporate Governance Rules set out the rights of shareholders, the guidelines for relationships with them, and the mechanisms for exercising their rights. These are also governed by the Saudi Company Law. The rules and procedures for shareholders to exercise their rights include rights relating to dividends, convening meetings, attendance and participation at meetings, voting rights and rights to information. There is also provision for shareholders to make complaints, which he is assured will be attended to. He is also entitled to a reply detailing any action taken regarding the complaint.

Information that is made available to the general public includes the Financial Statements, the Auditors Report and the Board of Directors Report; they are published in the press, the SAIB website and the Tadawul website. They are also separately disseminated to the shareholders.

The breakup of the shareholdings as at December 31, 2018 is as follows:

| 2018 | 2017 | |||

| Amounts in SAR million | Amount | % | Amount | % |

| Saudi shareholders | 6,750.0 | 90.0 | 6,750.0 | 90.0 |

| Foreign shareholders: | ||||

| J.P. Morgan International Finance Limited (Note 40) | – | – | 562.5 | 7.5 |

| Mizuho Corporate Bank Limited | 187.5 | 2.5 | 187.5 | 2.5 |

| Treasury shares (Note 40) | 562.5 | 7.5 | – | – |

| 7,500.0 | 100.0 | 7,500.0 | 100.0 | |

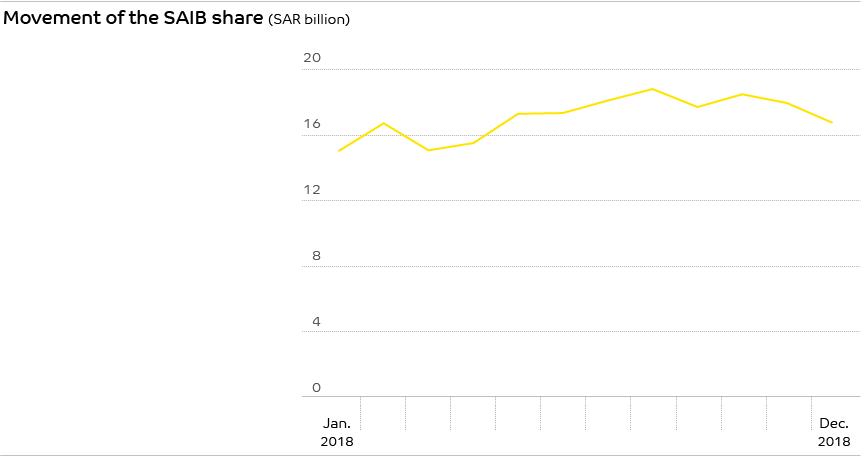

As of December 31, 2018, the market value of the Bank’s ordinary share was SAR 17.12 as against SAR 15.08 on December 31, 2017. During the year the highest price the share recorded was SAR 19.16 which was on July 19, while the lowest price the share recorded was SAR 14.57 which was on March 4.

| For the years ended December 31, | 2018 | 2017 | 2016 |

| Value, SAR million | 12,840 | 11,325 | 10,647 |

| Percentage of total market capitalisation | 2.07 | 2.42 | 2.48 |

| Key performance indicator | 2018 | 2017 | 2016 | 2015 | 2014 |

| Share Capital | 750 | 750 | 700 | 650 | 600 |

| Total shareholders’ equity | 11,653 | 13,494 | 12,833 | 12,036 | 11,852 |

| Basic and diluted earnings/share | 1.86 | 1.83 | 1.40 | 1.90 | 2.39 |

Our strategy in personal banking is based on closeness to the customer – offers are tailored to the situation of the customer. We focus on building a relationship with the customer to the extent of becoming a long-term financial partner. In the process we will ensure the financial prosperity of our customers both in the short and long term. To build the relationship towards our customers we make banking simple and accessible for each of our customers.

We assist in financial planning to protect the customers’ wealth and ensure that expected future cash flow requirements can be met. Through a good understanding of the customers’ needs and preferences we facilitate his financial and asset growth.

Our customer satisfaction surveys show a high degree of satisfaction as shown by the figures shown below:

| Year | ||||||

| Criterion | Unit | 2018 | 2017 | 2016 | 2015 | 2014 |

| Overall satisfaction | % | 81.85 | 82.52 | 85.61 | 79.58 | 85.22 |

| On account opening | % | 86.91 | 90.84 | 90.45 | 94.00 | 92.00 |

| On branch services | % | 99.57 | 99.12 | 99.17 | 99.00 | 99.00 |

| On loan services | % | 87.52 | 88.16 | 89.80 | 92.00 | 91.00 |

| On “Flex Click” internet banking services | % | 82.81 | 86.51 | 89.74 | 90.00 | 92.00 |

We have also achieved a Net Promoter score of +38 for personal banking customers.

It is also commendable that we have achieved almost uniform results in overall customer satisfaction across regions.

Our extremely satisfactory record in complaint resolution has greatly contributed to our achievements in customer satisfaction. In 2018, over 95% of complaints were resolved within five days.

| Year | ||||||

| Criterion | Unit | 2018 | 2017 | 2016 | 2015 | 2014 |

| Complaints Registered | Nos | 26,497 | 14,523 | 9,897 | 8,294 | 7,907 |

| Complaints resolved within 5 days | % | 96.53 | 99.03 | 98.06 | 99.00 | 99.00 |

Our focus in the year under review has been on digitalisation and automation. We have concentrated on channel migration and convenience to the customer. We are eliminating manual transactions as far as possible. Through Internet banking, mobile banking, self-service kiosks, ATMs, Cash Deposit Machines (CDMs) and Interactive Teller Machines (ITMs) we are eliminating the need for customers to visit branches.

Processes such as new account opening and new card issuing have been fully automated. We have achieved a degree of automation in these transactions as high as 98%. A new automated process has also been implemented to refinance customer loans through telesales. We do not intend to greatly increase the number of branches to widen our reach. Instead, we intend to set up more self-service kiosks in the more remote parts of the Kingdom.

The shift in channels has also been reflected in customer communication. The statistics of marketing and communication initiatives by channel given below show this trend:

| Year | |||

| Initiative type | 2018 | 2017 | 2016 |

| Marketing campaigns | 153 | 45 | 25 |

| Events | 62 | 85 | 30 |

| Emails to customers | 10,612,267 | 95,000 | 65,000 |

| Press releases | 54 | 54 | 40 |

| Unique visitors per month to SAIB Website | 215,906 | 179,432 | 132,122 |

| Page views per month | 1,002,738 | 732,875 | 571,313 |

| Twitter followers | 928,000 | 845,347 | 754,058 |

| Facebook fans | 1,298,437 | 1,317,206 | 1,278,533 |

| Instagram followers | 36,200 | 27,497 | 19,200 |

| Product and service social media videos | 62 | 30 | Not recorded accurately enough to report |

The trend is also shown in the statistics for e-channel penetration. It is also significant that customer surveys indicate a high degree of satisfaction with non-traditional channels.

An important change during the year, driven by regulatory change is the move to responsible banking. Formerly personal financing was governed by strict limits based on a percentage of income without taking the individual’s factors into account. The Bank has now moved to making decisions based on a 360 degree survey of the customer’s situation. We evaluate his disposable income based on his family situation and expenses, when making financing decisions without being bound by a rigid percentage of income formula. Thereby we avoid burdening lower Income customers with a repayment they are unable to keep up while we can be more flexible on the amounts, we loan to higher income clients. The outcome is win-win for both the Bank and customer. We have also seen a move from consumer finance towards housing finance which results in a lasting benefit for the customer.

Regarding customer segments affluent banking has been identified as a potentially lucrative one and we are specially catering to this group. Several of our branches do have Ladies sections. However, our recent experience has shown that our women customers do not have markedly different requirements from their male counterparts.

Our corporate banking function serves a diverse clientele, large corporates, mid-corporates and the MSME sector. The related organisational unit, the Corporate Banking Business Group, operates from three regional headquarters housed in Riyadh, Jeddah and Al-Khobar. Our programmes for the MSME sector contribute to the Vision 2030 of growing the sector’s contribution to the GDP to 35%. The government has shown its commitment to the development of the sector by establishing the MSME Authority, which is also a favourable development for us.

We offer a wide range of technology-enabled products to meet our clients’ diverse needs, including Islamic banking products. We also leverage the capabilities of our subsidiary and associate companies in providing the following products and services:

Corporate banking performed creditably well during the year despite the unfavourable general economic climate, with the customer base growing by 6%. However, it was helped by an increase in liquidity in the banking system. The trend towards digitalisation and automation was very visible in this product line too, with customer transactions automation reaching 92%. Several agreements have been signed with various government organisations to support certain priority sectors in line with plans for 2020 and 2030. Our expansion strategies during the year focused on the mid-market segment. We also initiated cash management services and sought to deepen client relationships; our cross-sell ratio reached 22%. In the large corporate sector, a major development was that we were a partner in a syndicated deal for aircraft purchasing.

The Bank’s Quality Assurance Group undertook several initiatives during the year to meet the requirements of SAMA, which also supported development, innovation and adherence to the best banking standards.

More than 400 Product/Service approval memorandums were published to meet SAMA standards. This enabled introducing necessary controls for each and every risk identified in a product or service before launching it. Customer complaints were resolved and delivered within time lines stipulated by SAMA within a 100% success rate. Site quality standards were developed to ensure that premises are maintained at world class standards and required maintenance is carried out within agreed timelines.

Resolution of customer complaints is carried out by the Customer Care Unit within Quality Assurance. The Mystery Shopper project evaluates the quality of customer service, including electronic channels. This project also assesses the quality of service SAIB provides compared with its competitors. The Quality Assurance Group also carried out a customer satisfaction survey which covered more than 80,000 customers. The survey has provided a measured degree of satisfaction with the banking products as well the efficiency of channels.

The Bank’s website was restructured to make it more user friendly and easier to navigate through with less clicks to a target page. The site’s content was reviewed and updated in consultation with all Bank Departments. The numbers of visitors increased by 27% during the year from 175,451 to 223,326 and the number of page views increased by 60% from 690,539 to 1,103,148.

A new revamped version of the Silah portal was launched to give it a facelift and enhanced functionalities. The new portal received excellent rating from new staff.

SAIB is the widest social media presence of any financial institution in Saudi Arabia.

In 2018 the loyalty team adopted a wide range of initiatives to build enrolment and retention. These included digitalisations and innovations; big data business intelligence research; costs optimisation; and business continuity.

During 2018, 153 marketing campaigns were launched compared to in 2017 which is a growth of 220%.

The major “Know Your Companion” Travel Card Campaign was launched in April 2018 and continued until September 2018. It was aimed at driving Travel Card usage, growing customer acquisition, increasing card issuance and further promoting the SAIB brand. This Above-the-Line campaign was targeted at existing customers as well as non-customers. Riyadh and Jeddah Airports were full branded with the campaign messages as too were strategic locations within the cities where the campaign was advertised using billboards. It was also promoted by inflight advertising on Saudi Airline’s inflight entertainment system. Results of the campaign showed an increase in average card issuance of 3,300 card per month and a spend growth of SAR 106 million.

The WooW programme is a loyalty programme offered by SAIB where members are rewarded with points for their transactions. The points earned can then be redeemed through various gifts and options through the WooW e-catalogue.

The enrollment data of WooW and points data is shown below:

Three WooW campaigns were launched as described below:

In addition, there was the WooW Friday programme which was a six-day campaign offering discounts on various gift items. The campaign resulted in the following positive outcomes during the campaign period:

Maintaining smooth relationships with business partners is essential for uninterrupted conduct of our operations. Long-term relationships based on mutual trust and confidence need to be built with vendors and service providers. We need to be ethical and transparent in our dealings with them and we expect our partners to reciprocate. Our procurement spending is mainly concentrated on utilities, stationery, equipment and software. SAIB is always conscious of the positive impact we can make through our purchasing to the local economy and to local communities. We therefore source from Saudi suppliers whenever possible. We regularly review the performance of our suppliers, both to ensure regular and quality supplies as well as to maintain good relations. We also meet our payment obligations in a timely manner.

Our network of correspondent banks serves the MENA, European, African and North American regions and play an indispensable role by supporting our overseas transactions.

There were 2.26 million fans/followers across all social media channels.

The external email marketing tool was launched to to increase the effectiveness of email marketing. There was a resulting increase in customer email data from 95,000 to 174,000 customers.

Increase in remittance accounts and travel card currencies from 7 to 50 has been a step towards realising the Bank’s vision of being the leading Travel Card program in the middle east and the 9th largest globally.

During the year detailed performance reports were prepared on each business partner company highlighting the Company’s background, products, market analysis, financial analysis, major risks and mitigation, valuations, and recommendations.

The reports were presented to ALCO and BOD. The shareholders’ agreement with American Express was amended and restated with five supporting agreements. This was completed through a process of active engagement with shareholders and legal advisors. SAIB’s share of Medgulf’s rights issue subscription of SAR 400 million (which amounted to SAR 76 million) was successfully completed. The Bank’s shareholding of SAR 0.9 million in the newly established Saudi Company for Registration of Finance Lease Contracts was completed afterall necessary approvals. The Bank’s margin lending portfolio was entirely transferred from SAIB to ICAP.

During the year a number of major initiatives and transactions were completed in partnership with other financial organisations.

In partnership with external shareholders and internal stockholders we were able to onboard SAIB markets limited SPV with counterparties by negotiating relevant documentation. Two new custody accounts were also opened. A deal was successfully closed with SAMBA for SAR 1 billion. Bilateral loan agreement for which the rate was reduced from 1.1% to 0.6% per annum while reducing the tenor from five years to three years and eight months.

Five new Vostro accounts were opened to increase the trade finance flow.

New trade finance flows of LGs totalling SAR 10.5 billion vs. SAR 4.5 billion were captured, which is a 57% increase compared to nine months to September 2017. Letters of credit totalling SAR 29 billion vs. SAR 12 billion, which is a 63% increase compared to nine months to September 2017 were opened. Risk participation has totalled SAR 127.5 million vs. 0 which is a 100% increase compared with nine months to September 2017.

The supplier and procurement numbers and costs, show a consolidation of suppliers while there has been an increase in costs.

| Year | |||||

| 2018 | 2017 | 2016 | 2015 | 2014 | |

| International suppliers | 39 | 79 | 24 | 25 | 30 |

| Local suppliers | 148 | 154 | 80 | 65 | 55 |

| Spending (international procurement) – SAR | 60,777,564 | 36,644,044 | 25,000,000 | 7,000,000 | 8,000,000 |

| Spending (local procurement) – SAR | 389,513,667 | 259,314,171 | 130,000,000 | 83,000,000 | 80,000,000 |

The GRI Gold Community is a network of diverse organisations encompassing corporates, consultancies, civil society, academia, labour, public sector, and inter-governmental organisations. This community plays a key role in charting the future of sustainability reporting. SAIB retained its GRI Gold Membership status based on its sustainability reporting and publically available disclosures on sustainability.

The UN Global Compact is an initiative in which companies participate voluntarily to align their strategies and operations with universal principles on the environment, labour, human rights, and anti-corruption.

SAIB retained for a third year its UN Global Compact (GC) status based on its Communication on Progress (COP) submission, demonstrating its commitment to and leadership in corporate sustainability governance. The Banks COP met all minimum requirements and qualified for the GC Active level. The Banks COP and the self-assessment is now publicly available on the Global Compact website.

SAIB joined the International integrated Reporting Council - Business Network, the first commercial entity to do so in the Middle East. This gives the Bank the opportunity to benefit from the experience of over 1,750 international participants and have peer-to-peer contact with reporting practitioners. The joining of the Business Network further reaffirms

the Bank’s ambition to make a significant difference locally and internationally to support better investment decisions and contribute to improved capital allocation and longer-term growth.

Invited Members of the Organisational Practice Committee with SASO to review and revise the ISO 26000 CSR standard for Saudi Arabia. We thereby made a contribution to enhancing the impact of CSR activities in the Kingdom in general.

SAIB was invited by the Ministry of Labor and Social Development to participate in a workshop about increasing the economic value for volunteering.

We were invited by King Salman Youth Centre to represent the private sector at a workshop about the role of CSR in achieving Vision 2030.

A settlement was arrived at in December 2018, between the Bank and General Authority for Zakat and Tax (GAZT) that the Bank’s Zakat assessments for the period 2006 to 2018 would be approximately SAR 775.5 million.

The agreed schedule of Zakat payments is as follows:

| SAR ’000 | |

| January 1, 2019 | 155,089 |

| December 1, 2019 | 124,072 |

| December 1, 2020 | 124,072 |

| December 1, 2021 | 124,072 |

| December 1, 2022 | 124,072 |

| December 1, 2023 | 124,072 |

| Total | 775,449 |

The Zakat settlement has been provided for through a charge to retained earnings with the corresponding liability included under other liabilities. The payment due on January 1, 2019 of SAR 155 million has been effected.

| GRI 102-9, 102-10; 103-1, 103-2, 103-3; 204-1; 308-1; 414-1; 418-1 |