Growing our volume while increasing our profitability can be achieved by expanding our reach through traditional and non-traditional channels. It can also be achieved through other strategic initiatives such as diversifying our product range and deepening our penetration of promising customer segments.

Growing our business volume while increasing our profitably is naturally a core objective. Growth can be achieved in a simple organic manner, by expanding our reach, both through brick-and-mortar branches as well as through other channels, especially digital channels. We can also pursue growth through diversification; widening our product range, deepening our penetration of select customer segments, optimising our product tenure and tapping the potential of hitherto underserved areas of the Kingdom. However, if we are to increase our profitability while growing, we need to keep costs under control. We also have to keep in mind the regulatory requirements of capital adequacy.

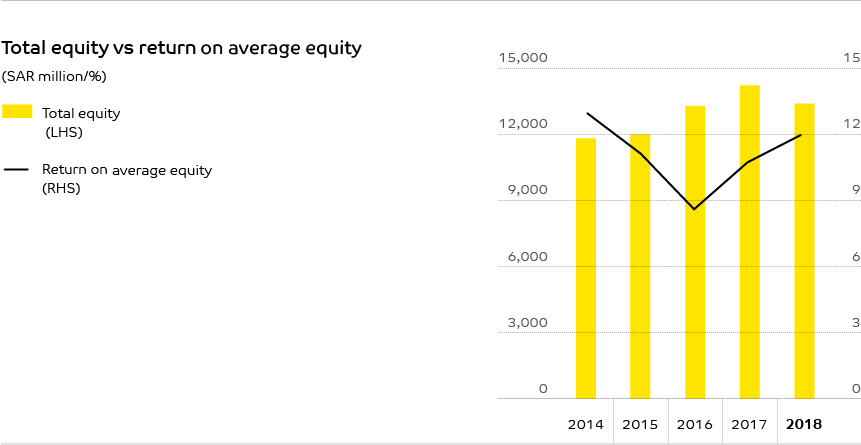

Some of the key indicators of profitability showed a modest increase in 2018. The net income for the year was SAR 1,459 million which was an increase of 3.40% over the 2017 figure of SAR 1,411 million. The return on average assets rose from 1.51% in 2017 to 1.54% in 2018. The return on average shareholders’ equity was 11.99% (2017:10.72%).

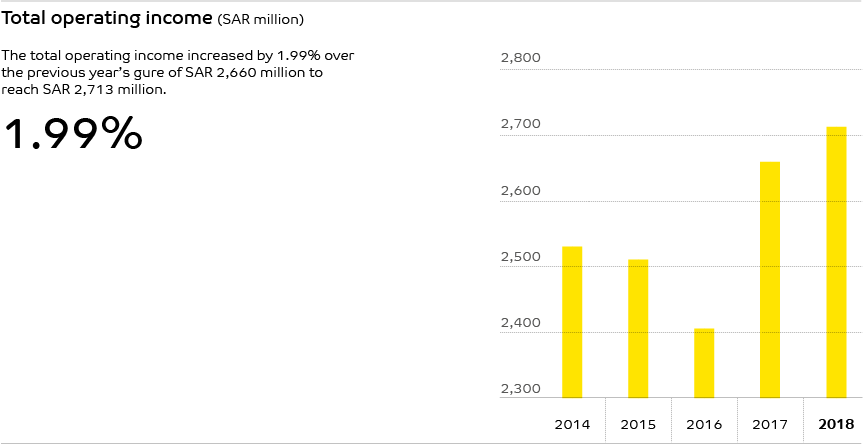

The total operating income increased by 1.99% over the previous year’s figure of SAR 2,660 million to reach SAR 2,713 million. Regarding the components of the operating income, the largest contributor which is net special commission income was SAR 2,288 million, an increase of 5.24% over the previous year (2017: SAR 2,174 million). Net special commission income, which includes special commission income (from placements, investments and loans), less special commission expense (an deposits and other borrowings) and fees from banking services increased by 5.36% from SAR 280 million to SAR 295 million in 2018. Exchange income increased by 2.92% to SAR 141 million (2017: SAR 137 million). Dividend income dropped from SAR 20 million to SAR 5 million due to a planned reduction in the Bank’s equity investments. All other operating income, consisting mainly of gains and losses through investments, resulted in a net loss of SAR 16 million in 2018 compared to a net gain of SAR 49 million in 2017.

Considering the regional distribution of operating income, the Central Region has accounted for 74.29% of the total. This is a considerable increase over the previous year’s figure of 66.29%.

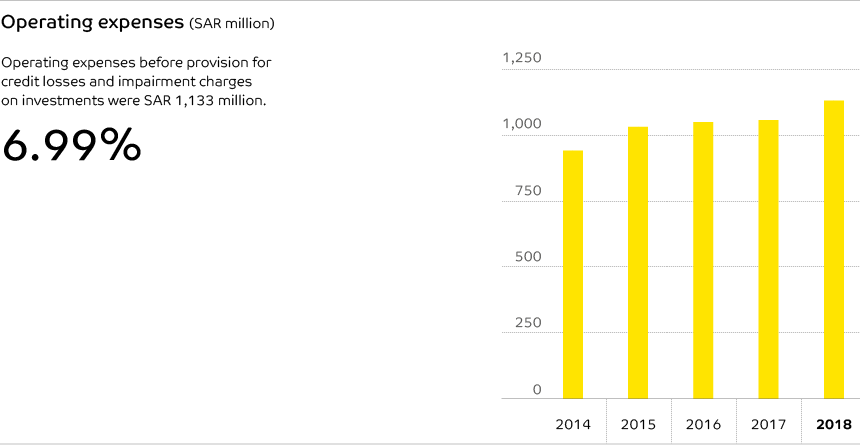

Operating expenses before provision for credit losses and impairment charges on investments were SAR 1,133 million which was a 6.99% increase over the 2017 figure of SAR 1,059 million. There was a slightly adverse movement in the efficiency ratio which increased from 38.01% in the previous year to 39.09%.

Salaries and employee-related expenditure increased by 8.10% to reach SAR 626 million (2017: SAR 579 million). Compared with 2017, general and administrative expenses increased by 11.67%, depreciation and amortisation increased by 11.54%, while rent and premises expenses decreased by 6.19%.

Total assets were SAR 96.1 billion as at end of 2018 compared with SAR 93.8 billion a year before which was an increase of 2.45%. The return on average assets increased from 1.51% the previous year to 1.54%.

Loans and advances, net remained flat (2018, SAR 59.4 billion: 2017, SAR 59.6 billion). Non- interest-based banking products accounted for SAR 37.1 billion of the total loans and advances (2017: SAR 37.3 billion). The estimated fair value of collateral held as security for loans and advances was SAR 49.4 billion (2017: SAR 46.1 billion). The provision for credit losses for 2018 totalled to SAR 247 million (2017: SAR 213 million). The provisions included the requirements of IFRS 9 for all types of loans, advances and other receivables. Due to the adoption of IFRS9 on January 1, 2018, the Bank recognised fair value changes in its equity investments in other reserves.

The five-year trend of SAIBs share of the total assets of Saudi Banks is given below:

| Unit | Year | |||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||

| SAIB Market share | % | 4.24 | 4.22 | 4.26 | 4.31 | 4.46 |

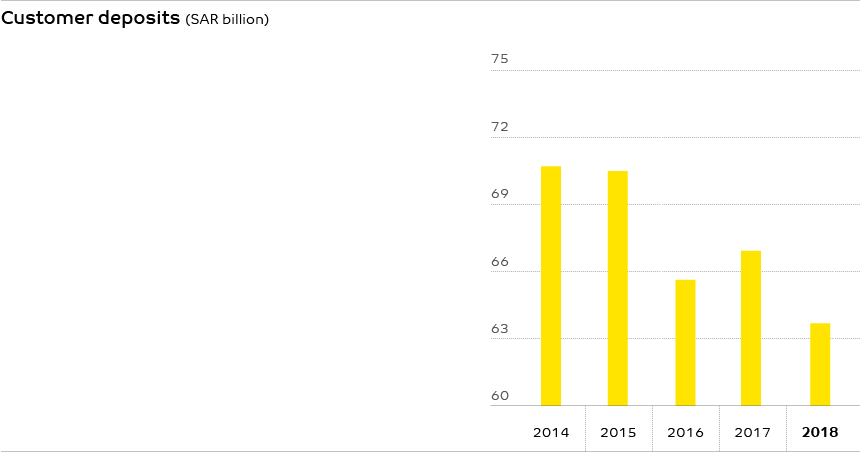

Customer deposits decreased by 4.86% to SAR 63.7 billion at the end of 2018. Demand and other deposits decreased by 1.32% and accounted for 39.45% of total deposits (2017:38.03%). Special commission bearing deposits decreased by 7.03 % in 2018.

The five-year medium-term loan facility which SAIB entered into for an amount of SAR 1.0 billion on June 19, 2016, has been fully-utilised and is fully repayable on June 19, 2021. On September 26, 2017, the Bank entered into another medium-term loan facility also for SAR 1.0 billion, which was fully utilised on October 4, 2017 and is repayable on September 26, 2022. Both loans were for general corporate purposes.

The above term loans bear commission at market-based variable rates but are subject to an option for the Bank to effect early repayment subject to the terms and conditions of the related facility agreements. The agreements carry a responsibility to maintain certain requirements, including financial ratios, with which the Bank is in compliance. There have not been any defaults of principal or commission on the term loans.

On June 5, 2014 the Bank completed the issuance of a SAR 2.0 billion subordinated debt issue. This was executed through a private placement of a Shariah compliant Tier II Sukuk in the Kingdom. The Sukuk carries a half yearly profit equal to six-month SIBOR plus 1.45 %. It also carries a maturity period of 10 years with the Bank having the rights to call the Sukuk at the end of the first five years, subject to certain regulatory approvals.

All documentation related to SAR 1000 million. tranche of Tier 1 Sukuk was completed in 2018 and the issuance was successfully completed, including all regulatory and other legal formalities.

The Treasury and Investments Group (TIG) of the Bank handles foreign exchange trading, funding, and liquidity management, the Bank’s investment portfolio and derivative products.

In 2018 the Group made a very significant contribution to

the Bank’s financial results, surpassing its performance in

2017 and its budget target. TIG net income for 2018 was SAR 792.2 million compared to SAR 392.6 million in 2017, which was an increase of 102%. The contribution to the Bank’s net income was 73% as against 37% in 2017. TIG’s net adjusted income was SAR 357.5 million compared to SAR 198.5 million in 2017. On adjusted basis the contribution to the Bank’s net income was 33% (2017: 19%).

The components of the income for the two years are

shown below:

| 2018 SAR million |

2017 SAR million |

|

| Exchange income | 106.8 | 102.8 |

Dynamic management of the investment portfolio by investing and re-investing total funds of SAR 4.55 billion yielded a risk/reward average purchase yield of 3.99%. The investment portfolio was optimised by investing and re-investing SAR 3.54 billion of high-quality liquid assets that consist of sovereign and quasi-sovereign issuer. This improved the portfolio average yield from 3.44% on SAR 24.7 billion in December 2018 compared to weighted average yield of 3.12% on portfolio 21.5 billion in December 2017. The weighted average rating of newly purchased securities of SAR 3.54 billion was A- and eligible for HQLA. The interest rate portfolio interest rate exposure was strategically shifted to floating rate by applying interest rate hedges.

The balance sheet was further strengthened by maintaining a loan-to-deposit ratio at December 31, 2018 of 93%. Prudent liquidity management was achieved by maintaining an average liquidity ratio for the year of 25.64% (month end 24%). The top 20 depositors’ concentration as at December 31, 2018, was 35.44% compared with the threshold of 45%. The third tranche of Tier 1 Sukuk programme of SAR 1 billion was closed.

The number of client visits was increased to 410 in 2018, compared with 356 in 2017, which was an increase of 15%. Due to a business slowdown in 2018, the total volume of business in the four major currencies (USD, EUR, GBP, and AED) has decreased by an equivalent of SAR 2.5 billion (-9.7%). However, the profit generated from these four currencies has increased by SAR 27.1 million, which is an increase of 11.7%.

Although the Bank lost clients who contributed SAR 6.1 million in 2017, this was more than compensated for by new clients who added SAR 11.44 million to the total profit. These new clients contributed 16% of total foreign exchange profit flow. The first historical structured deposit trades (six trades) of tenors 3.4 and 5 years to assist in raising long-term funding of a total SAR 2.55 billion Five syndicated hedging requirement transactions of a total size of USD 92.5 million were also executed.

*The figures in this section are for Q3 2018.

The Saudi Arabian Banking Control Law and the Articles of Association of the Bank stipulate that a minimum of 25% of the annual net income should be transferred to a statutory reserve until this reserve equals the paid-up capital of the Bank. Accordingly, a transfer of 365 million has been made from the net income for 2018. The statutory reserve is not currently available for distribution.

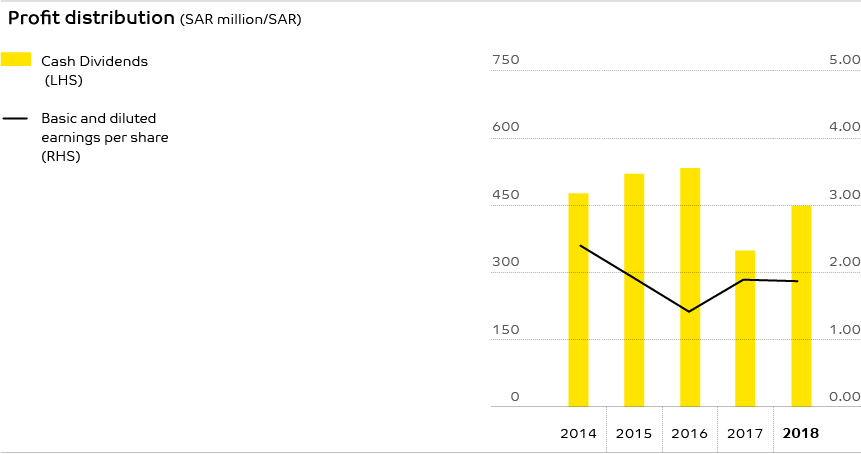

In 2018 the Board of Directors proposed a cash dividend of SAR 450 million equal to SAR 0.60 per share, net of Zaket to be withheld from Saudi shareholders. The proposed cash dividend of SAR 350. This dividend was approved by the Bank’s shareholders at an Extraordinary General Assembly meeting held on 8 Shaban 1439H (corresponding to 24 April 2018), after which the net dividends were paid to the Bank’s shareholders.

Our customer numbers have shown a steady increasing trend in personal banking and corporate banking.

| Customer type | Year | ||||

| 2018 | 2017 | 2016 | 2015 | 2014 | |

| Personal banking | 446,684 | 381,571 | 315,891 | 248,760 | 185,868 |

| Corporate banking | 1,540 | 1,450 | 1,407 | 1,367 | 1,205 |

| *MSME | **11,940 | 15,936 | 13,704 | 10,441 | 7,300 |

** Reduction in MSME accounts from 2017 to 2018 due to accounts being abandoned.

During the year, we expanded our reach both by conventional and alternative channels. The details of numbers of access points and transactions are shown below. Although the number of branches has increased only slightly, the number of transactions has increased by 52.3%. The details of numbers by transaction type are given below:

The results show a balance of growth across both types of channels. Branch transactions have grown by over 50% while ATM transactions have grown by less than 10%. On the other hand, online as well as point of sale transactions have increased by around 50%.

SAIB has three main business lines: retail, corporate and treasury and investment.

Retail Banking offers both Shariah compliant and conventional banking products and services through its network of branches, ATMs and the Head Office. The products include current, savings and time deposit accounts.

Corporate Banking group serves a range of clients including large corporates and MSME (micro, small and medium enterprises). Corporate banking products are also both conventional and Islamic. They include working capital financing, trade financing, contract financing, project financing, cash management, syndicated loans, capital expenditure financing and real estate development financing. The Corporate Banking group operates from three regional headquarters in Riyadh, Jeddah and Al-Khobar. The services are continuously improved to meet changing customer needs, leveraging the latest technology.

Treasury and Investment handles foreign exchange trading, funding, liquidity management as well as the Bank’s investment securities portfolio and derivative products.

SAIB provides its premium customers with three customer programmes Silver, Gold and Platinum which are tailored to their specific needs. Gold and Platinum customers receive special customer service in luxurious comfort and in

total privacy.

In 2018, there was a decrease in the total equity of the Bank from SAR 14.3 billion the previous year to SAR 13.4 billion. The decrease was due to the adoption of IFRS 9, settlement of prior year Zakat obligations and the purchase of Treasury Shares. The ratio of total equity to total assets declined from 15.22% in December 2017 to 13.99% in December 2018.

On January 1, 2018 the Bank adopted the expected credit loss (ECL) model mandated by IFRS 9. The move to IFRS 9 was made retrospectively without restating the prior year comparative amounts reported. This resulted in a net reduction of total equity of SAR 823 million on January 1, 2018.

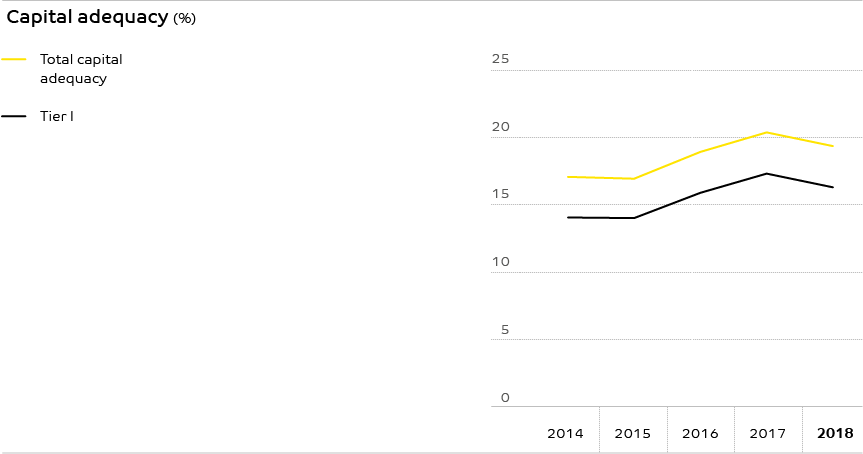

The Bank strictly adheres to the capital requirements set by SAMA to ensure its financial stability and maintain a strong capital base. SAMA requires maintenance of a minimum level of regulatory capital as well as a ratio of total regulatory capital to risk weighted assets above 9.875%. The different types of assets are given an appropriate weighting to reflect their level of risk. As at December 31, 2018, the Tier I plus Tier II capital adequacy ratio stood at 19.36%. Although this was a decrease from the previous year’s figure of 20.38%, it was still well above the regulatory minimum.

In today’s globalised financial environment, international credit ratings are essential for any financial institution which is a major player. They are essential not only to be able to obtain financing and access to global capital markets, but also to demonstrate a high level of adherence to international credit and risk management standards. During 2018, the Bank continued its ratings reviews with Standard and Poor Rating Services (S&P) and Fitch Ratings.

S&P has maintained the Bank’s long-term and short-term credit ratings at “BBB”/ “A-2” with a stable outlook. S&P defines these ratings as follows:

An obligor rated “BBB” has adequate capacity to meet its financial obligations. However, adverse economic conditions or changing circumstances are more likely to lead to weakened capacity of the user to meet its financial obligations.

An obligor rated “A-2” has satisfactory capacity to meet its financial obligations. However, it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in the highest rating category.

Fitch affirmed the Bank's “BBB+”/“F2” long-term and short-term ratings with stable outlook. Fitch defines these ratings as follows:

“BBB+” ratings indicate that there is currently expectation of low credit risk. The capacity for payments of financial commitment is considered adequate but adverse changes in circumstances or economic conditions are more likely to impair the capacity.

“F2” ratings indicate good credit quality with a satisfactory capacity for timing of financial commitments, but the margin of safety is not as high as in the case of the higher ratings.

The Bank’s ratings reflect our financial performance, asset quality and capitalisation levels, underpinned by sound strategies and an adequate liquidity profile. The fact that the Bank operates in one of the strongest banking sectors and best regulated markets in the Middle East and among all emerging markets have also contributed to the ratings. So have Saudi Arabia’s sovereign credit ratings from S&P and Fitch, in addition to the country’s economic fundamentals.