SAIB’s overarching purpose is to create value – in the short, medium and long term. Value creation is a two-way process; we deliver value to our stakeholders as well as derive value from them. Value creation has to be viewed in the context of the environment within which we operate and the needs and priorities of the stakeholders. To identify the topics which need to be focused on in this Report, we have to first determine which topics have the most impact on our value creation process.

The first step in this process was to carry out a PESTEL analysis of potential material issues categorised under the stakeholder group on which they have the most impact. The results of this analysis are shown below:

| Stakeholders | Political A |

Economic B |

Social C |

Technological D |

Environmental E |

Legal/Regulatory F |

|

| Investors/ Shareholders |

Economic slowdown |

Growing influence of social media | Unorthodox competition |

IFRS 9 | 1 |

||

| Depreciating currencies against USD |

Basel III | 2 |

|||||

| Expected growth in the Saudi economy |

Higher regulatory capital |

3 |

|||||

| Financial system stability |

Governance and accountability | 4 |

|||||

| Customers |

Propensity to invest in Saudi |

Increasing customer expectations (especially in the younger generation) |

Cloud | Adherence to Islamic banking principles |

5 |

||

| Corporates are de-leveraging |

Customer trust and protection |

e-onboarding | 6 |

||||

| Increase in non-performing loans |

Quality of service and customer satisfaction |

Digitalisation and automation | 7 |

||||

| New parallel stock market being set up for MSMEs |

Engaging with customers |

Innovation | 8 |

||||

| Higher oil prices | AI, Robotics | 9 |

|||||

| Higher | Blockchain | 10 |

|||||

| Cyber security | 11 |

||||||

| Infrastructure | 12 |

||||||

| Data security | 13 |

||||||

| Employees |

Employee productivity | Technology driving change in job skills | Human and labour rights | 14 |

|||

| Staff retention | Operational efficiency | 15 |

|||||

| Saudization | 16 |

||||||

| Employee satisfaction and engagement | 17 |

||||||

| Staff training | 18 |

||||||

| Soft skills development | 19 |

||||||

| Equal opportunity and anti-discrimination | 20 |

||||||

| Society and environment |

Geopolitical conflicts | Need to commit to Sustainable Development Goals |

Reduction of environmental impact of operations |

ESG in risks lending and investment |

21 |

||

| Higher spending power in local population |

Increasing demand for green banking and green lending |

Compliance with regulations |

22 |

||||

| Community investment and engagement |

23 |

||||||

| Business partners/ Suppliers |

Sustainable procurement |

24 |

|||||

| Strengthening relationship |

25 |

||||||

| Government/ Policy makers |

Expected increase in non-oil revenue |

26 |

|||||

| Slow growth in economic integration in the GCC |

27 |

||||||

| Growth of MSME sector being part of the Vision 2030 goals |

28 |

||||||

| Diversification of the economy being one of the Vision 2030 goals |

29 |

||||||

| Regulators |

Business ethics and prevention of financial crime |

30 |

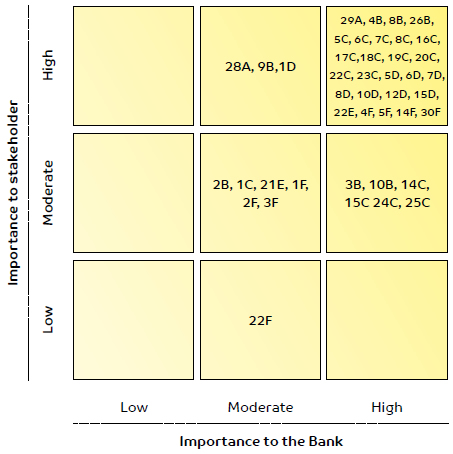

The next step was to map the topics that have the most impact on the stakeholders and/or SAIB itself. The topics have been categorised as risks or opportunities or both.

The degree of materiality or importance of a topic is assessed by its relevance to SAIB or the stakeholder and significance, the latter being determined by the probability of occurrence and the magnitude of its impact. Material risks and opportunities are further analysed as being of high, moderate or low importance to the business and its stakeholders.

The outcomes of the materiality analysis, contributed to the formulation of strategies and strategic imperatives.

Material topics are managed in accordance with the strategic plan and responsibilities are assigned to the respective functional unit heads according to the Organisation structure. The degree of materiality of a risk or an opportunity will be a guideline for resource allocation. The Bank has crafted and implemented many policies relevant to material topics to guide its employees in conducting their duties.

| GRI 102-47 |