We are coming to the end of one stage of our strategic evolution where we identified and focussed on promising markets, product segments and strategic initiatives. Given our results thus far, we can look forward to the future with confidence.

The operative strategic plan of the Bank is the one for the period 2015-2019 with the theme “Building on Strengths”. The plan was developed based on the achievements and learning experiences of the previous plan. The goals of the plans were primarily customer focused, based on a study of where the Bank was placed in the industry and the Bank’s strengths and weaknesses when the plan was formulated.

A four-step methodology was adopted for developing the strategic plan:

Inputs for the plan were also obtained from meetings, surveys and workshops with staff.

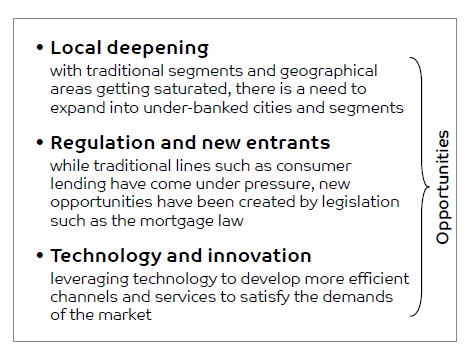

The following trends were identified in the Kingdom’s banking sector. From these trends we were able to identify threats and opportunities. We were also able to identify product segments, customer segments, geographical markets and channels to focus on for expansion:

Regarding financial performance, the main objectives have been to increase revenue while significantly increasing profitability and maintaining the capital adequacy ratio.

From a study of the developments in the operating environment, results of stakeholder engagement and our knowledge of the position of SAIB within the industry, we were able to arrive at broad strategic imperatives to focus on. Within these broad imperatives we have identified, at a more granular level, sub-focus areas which are the strategies.

At the outset a target was set at growing assets at a rate of 8%, which is slightly above the market rate. However, to achieve this there are many considerations that have to be taken into account and balances need to be struck. The more profitable areas, such as demand deposits have to be identified. In common with its counterparts, the Bank has to strive to increase fee-based income.

Given the nature of the banking business, a balance has to be maintained between risk and profitability. The Bank has to adhere to requirements such as capital adequacy and related regulatory provisions such as IFRS 9 and Basel 3.

When transaction volumes expand, operating costs too tend to increase which has to be kept under control if profitability is to increase. Careful credit control has to be exercised in lending to minimise non-performing loans.

The development of systems and processes has been well aligned with the strategic plan and supporting operational initiatives. Supporting processes have to be developed for key elements of the plan. As an example, cross selling has to be implemented not only across organisational units of SAIB, but across corporate lines as well. Thereby we can develop cross selling opportunities leveraging the specialised products that subsidiaries offer. To achieve this, organisational silos had to be broken down.

For successful development and implementation of systems and processes accurate and timely information has to be provided to the required level of granularity. The Sustainability Dashboard Management System (SDMS) has been developed for this purpose.

To grow and prosper we need to develop lasting and mutually beneficial relationships with customers, investors and business partners. To gain their trust we need to be transparent and honest in our communication. We also need to adopt the most effective and appropriate channels of communication. In the case of customer transactions, there is an extremely diverse range of touch points that has been enabled by technology today in addition to the traditional brick and mortar branches – internet, mobile, ATMs, CDMs, IVR, and self-service kiosks. Many regions of the Kingdom are underserved but when expanding our reach we have to select the most cost-effective channels.

Today markets are evolving with dizzying rapidity – customers are becoming more and more exposed to modern trends. The population, especially the younger generation, is becoming increasingly technology savvy. Women are increasing their presence in the market.

The new products and services that are being introduced are increasingly digital in character; this applies to both the personal banking and the corporate banking segment. There are also very lucrative opportunities in market niches such as affluent banking.

Development of our staff is a continuous ongoing process. Employees have to be trained to keep up with the changing technology and cater to the evolving customer needs. Similarly, in the process of recruitment we have to hone our processes to select the best available people and place them in the most appropriate positions.

We are committed to increasing Saudization and increasing the percentage of women employees. We do our utmost to help our female staff balance their career growth and their family responsibilities. In our relationships with our staff we are very conscious of human rights considerations as well as health and safety issues.

We do not concentrate completely on the bottom line, but as a responsible corporate seek to fulfil our social responsibilities. We minimise the environmental footprint in our own activities. We have also implemented an Environmental Management System (EMS), which caters to the ISO 14001 standard.

We also carry out a large number of social programmes with educational, health and charity objectives.

In addition all the strategies may address contributing to the goals of Vision 2030.

| GRI 103-1, 103-2, 103-3 |